The Fed's Pivot That Will Push Markets to New Heights

Nov 02, 2025

The Fed Just Took Their Foot Off the Brake

Look around at the markets and you'll see records everywhere...

✅ Stock market? All-time highs.

✅ Gold? Record territory.

✅ Home prices? Still near peaks despite rates over 6%.

✅ Even your grocery bill is setting personal records every month.

What's interesting is that this is happening at the same time that the Fed has been driving the economy with one foot on the brake.

It's been their way of trying to cool inflation while not completely crushing the economy.

But last week, something changed.

And if you're in real estate, you need to understand what just happened.

A Market Shift With Big Implications 😳

At the last week's meeting, Jerome Powell announced that the Fed would cut the Federal Funds Rate by another 0.25%.

The move was small and expected.

But things got a bit more spicy when Jerome Powell went out of his way to tell reporters not to expect another rate cut in December.

The market wasn't so happy at this news and rates spiked higher.

While everyone is talking about the potentially cancelled rate cut, there's a major update that deserves your attention.

J-rome also announced that the Fed will completely end quantitative tightening (QT) on December 1st.

Let me translate...

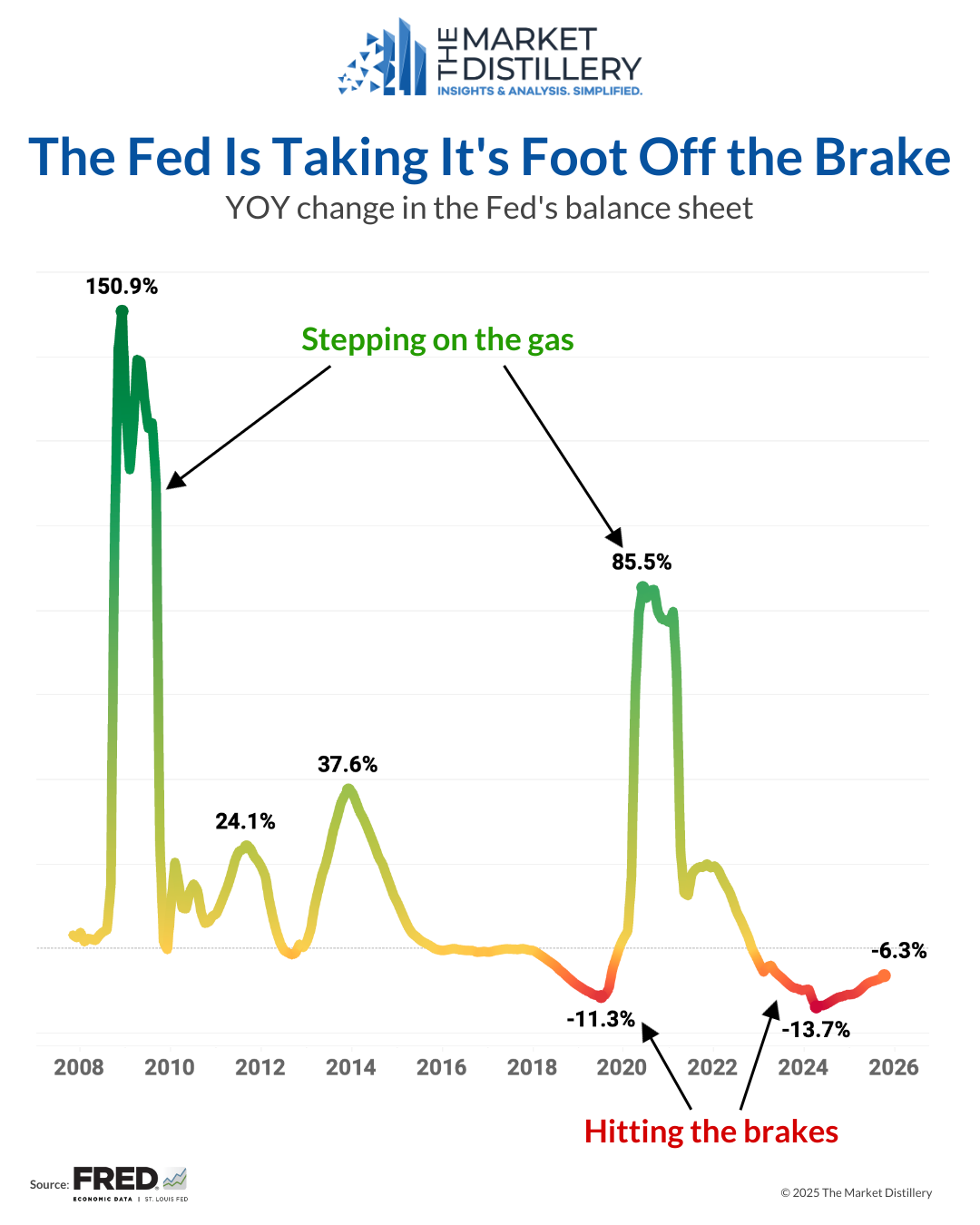

The Fed has been slowly selling bonds it owns to pull money out of the system – about $2.2 trillion worth over the past three and a half years.

That's like the Fed keeping their foot on the brakes while driving the car (our economy) forward.

Now, they're taking their foot completely off it.

Here's a chart that helps us visualize how the Fed presses the gas and brake over time:

What The Fed's Moves Mean for Real Estate Agents and Investors 🏠

This is one of those moments where markets shift.

We've been living through a challenging real estate market for the past 3 years, but the next phase should be a momentum boost.

Here are some major implications from this latest announcement:

- 💥 A boom without a crash? The Fed didn't wait for something to officially brake to start cutting rates. This appears to be a proactive move that could push markets higher without waiting for a crisis to justify it.

- ⚖️ The Fed is prioritizing the economy over inflation. Printing money while inflation is at 3% (before tariffs have made their way into prices) tells me that we should get used to continually rising prices. This will limit how low mortgage rates decline.

- 🤑 The divide between owners and renters will widen. When markets continue to rise, asset owners are the ones who benefit. The entry-level buyers who don't have stock portfolios or existing properties to trade will continue to get left behind.

With all this said, the question isn't whether prices will keep rising. It's whether your buyers will be able to participate at all.

Are you helping your people see the opportunity? 🚀

![]()

Dr. Alex Stewart

Founder

Realtors: want to be confident discussing the market? 🚀

If you're like so many of the Realtors I meet, you know understanding the local market is one of the most important things you can do as a real estate agent.

Everyone asks "how's the market?" when you meet them and the way you respond either opens a door of opportunity or shuts it.

Most Realtors have the stats but don't know what to do with them. There's so much going on that it gets confusing quickly.

If this sounds like you, My Market Insiders coaching could be just what you need. It's part local market updates, part business strategy so that you can be clear about exactly what's happening in the market and how to use that expertise to attract your ideal clients.

Members rate it 9.8 out of 10 for value to their business and increase their confidence talking about the market by 24%.

Click the button below to learn more about the program and if it's right for you ⤵️