Will inflation kill the real estate party even if the Fed cuts rates?

Aug 18, 2025

What inflation is telling us about interest rates... 😳

Just about everyone is waiting for lower interest rates.

I know you and your clients are!

In fact, most people assume that the Fed will start cutting rates and we'll get lower rates within a year.

They're thinking it's just a matter of time.

This is also causing a lot of people to hold off from buying or selling in the hopes that the market will be "better soon" when the Fed starts cutting.

But is that realistic?

To answer that, we need to look at a key factor that impacts interest rates: inflation.

The most recent inflation data was released last week so let's dig in and see what we need to know...

💵 How inflation impacts interest rates

First, let's define inflation so we're all on the same page.

Inflation is an increase in the amount of money that exists which then causes prices to rise as people have more money to bid everything up.

Now, lenders care about inflation a lot.

This is because they want to ensure they make a real profit on their loans.

AKA a profit above and beyond the inflation rate.

You see, when they loan out the money, their profit comes in the form of the interest payments they receive in the coming years.

To make sure they have profits in the future, the banks factor in inflation when setting the interest rate of their loans.

If there's higher inflation, they'll charge a higher rate since money won't buy as much in the future.

📈 What's the current inflation rate

There are a number of ways you can measure inflation, but the longest-standing and most popular way is through the Consumer Price Index (CPI).

The government office that produces the CPI price shops a large number of products and services people buy each month to measure how they change over time.

In fact, there are a couple primary versions of the CPI that I keep an eye on:

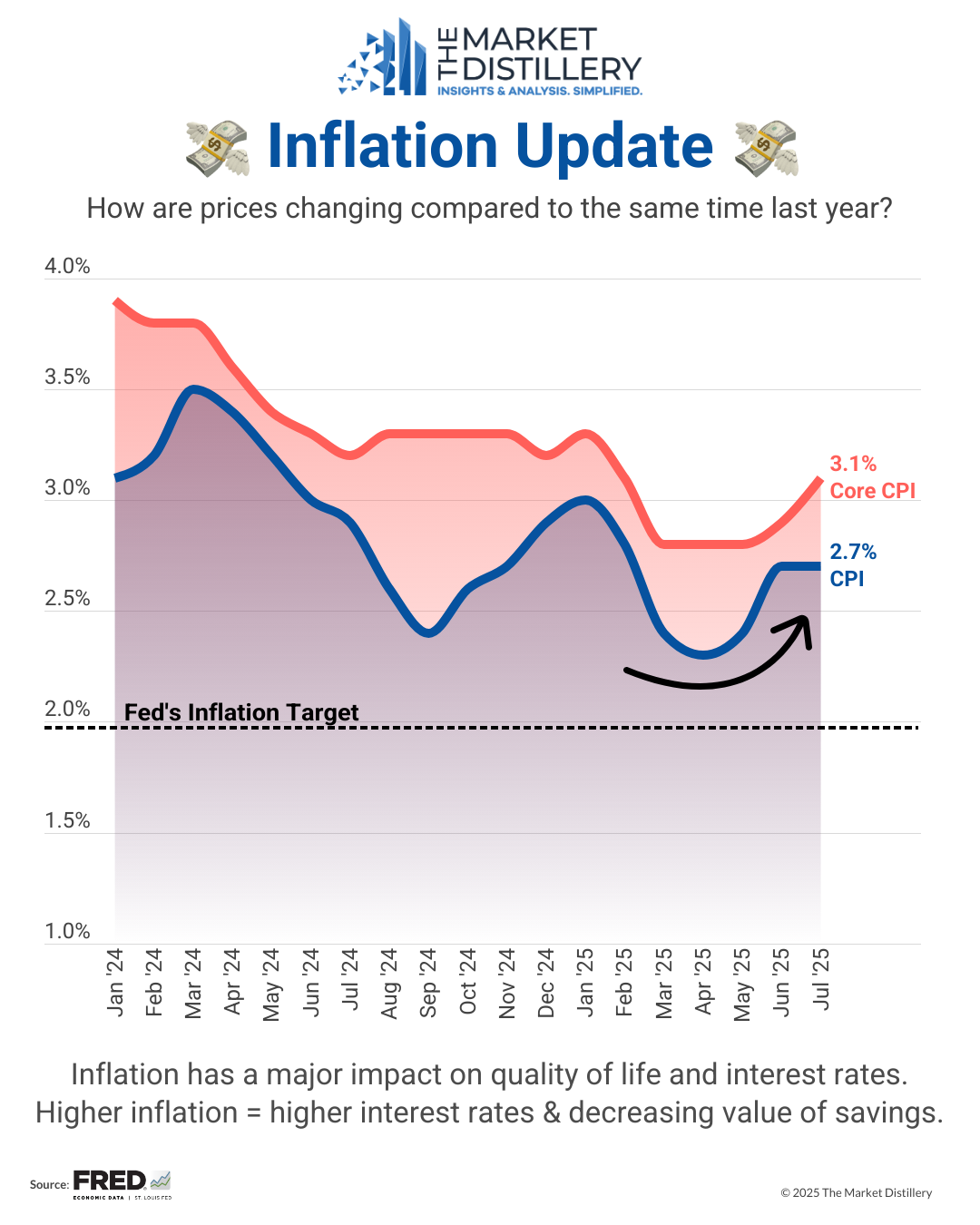

- Total CPI which includes everything

- Core CPI which excludes food and energy prices

Let's take a look at both to see how inflation has changed recently:

✅ Things you should know about inflation

The first thing you might notice is that the blue line (Total CPI) moves up and down a bit more than the red line (Core CPI).

This is one reason why the Fed pays a little more attention to Core CPI - it's a more consistent way to measure inflation that keeps them from overreacting to a short-term change.

The next thing to note is that the Fed has a 2% inflation target.

We've talked before about how this is just a made up number, but it's what the Fed is measuring their results against.

Either way you look at it, inflation is 35-55% above the target...

The final takeaway you should recognize is that since Spring, we've gone the wrong direction and inflation has started to increase again.

Maybe it's just a blip or maybe it's a more significant trend.

💡 What does this mean for interest rates

Bottom line: we might not see rates come down like everyone thinks - even if the Fed cuts the Federal Funds Rate!

It's entirely possible that mortgage rates don't drop as the Fed's cuts rates if lenders are concerned about persistently high inflation.

Just think back to when the Fed started cutting rates most recently.

As soon as the Fed actually cut rates, mortgage rates went up!

As a Realtor, this is an important topic to become familiar with because you've already got buyers and sellers saying they'll wait until the market is more favorable as the Fed cuts rates.

Nobody in real estate wants to believe rates might remain where they are because they want lower rates.

But we've got to be open to the possibility.

The Realtors and buyers/sellers who recognize this possibility are the ones that won't get caught without a plan if rates stay elevated.

And they'll provide the most responsible, realistic advice to their clients.

Remember, mortgage rates are still more than a percent below the long-term average of 7.75% so in truth, rates aren't even high right now..

Also, inflation is just one half of the factors that the Fed is weighing when deciding what to do with rates.

We talked in depth at our latest member MarketPulse 360 about this situation and how to navigate the coming changes.

If you want some help developing a business that thrives in any market, I've got a few spots left in my Market Insiders coaching membership. Secure yours before the opportunity is gone.

We make sure you know exactly what's happening and how to translate that into specific actions to guide your clients and grow your business.

Here's to a great week ahead! 🚀

![]()

Dr. Alex Stewart

Founder

Realtors: want to be confident discussing the market? 🚀

If you're like so many of the Realtors I meet, you know understanding the local market is one of the most important things you can do as a real estate agent.

Everyone asks "how's the market?" when you meet them and the way you respond either opens a door of opportunity or shuts it.

Most Realtors have the stats but don't know what to do with them. There's so much going on that it gets confusing quickly.

If this sounds like you, My Market Insiders coaching could be just what you need. It's part local market updates, part business strategy so that you can be clear about exactly what's happening in the market and how to use that expertise to attract your ideal clients.

Members rate it 9.8 out of 10 for value to their business and increase their confidence talking about the market by 24%.

Click the button below to learn more about the program and if it's right for you ⤵️