Decoding Real Estate: Why Waiting for Lower Interest Rates Might Cost You

Aug 13, 2023

Having the right perspective is incredibly valuable.

Those with the right perspectives tend to make better decisions.

I imagine you've heard plenty of people say they're waiting for rates to come down and then will buy/sell. 😤

In today's letter, we'll go over a few of the graphics from last week's deep dive on interest rates designed to help us all gain more perspective.

With so many people waiting for rates to come down to take action, we need to be prepared with the data on the topic to help them see the full picture in order to make an informed decision on when to act. 👨💼👩💼

Check out the full post to see all the slides.

Case Study: Mortgage Rates

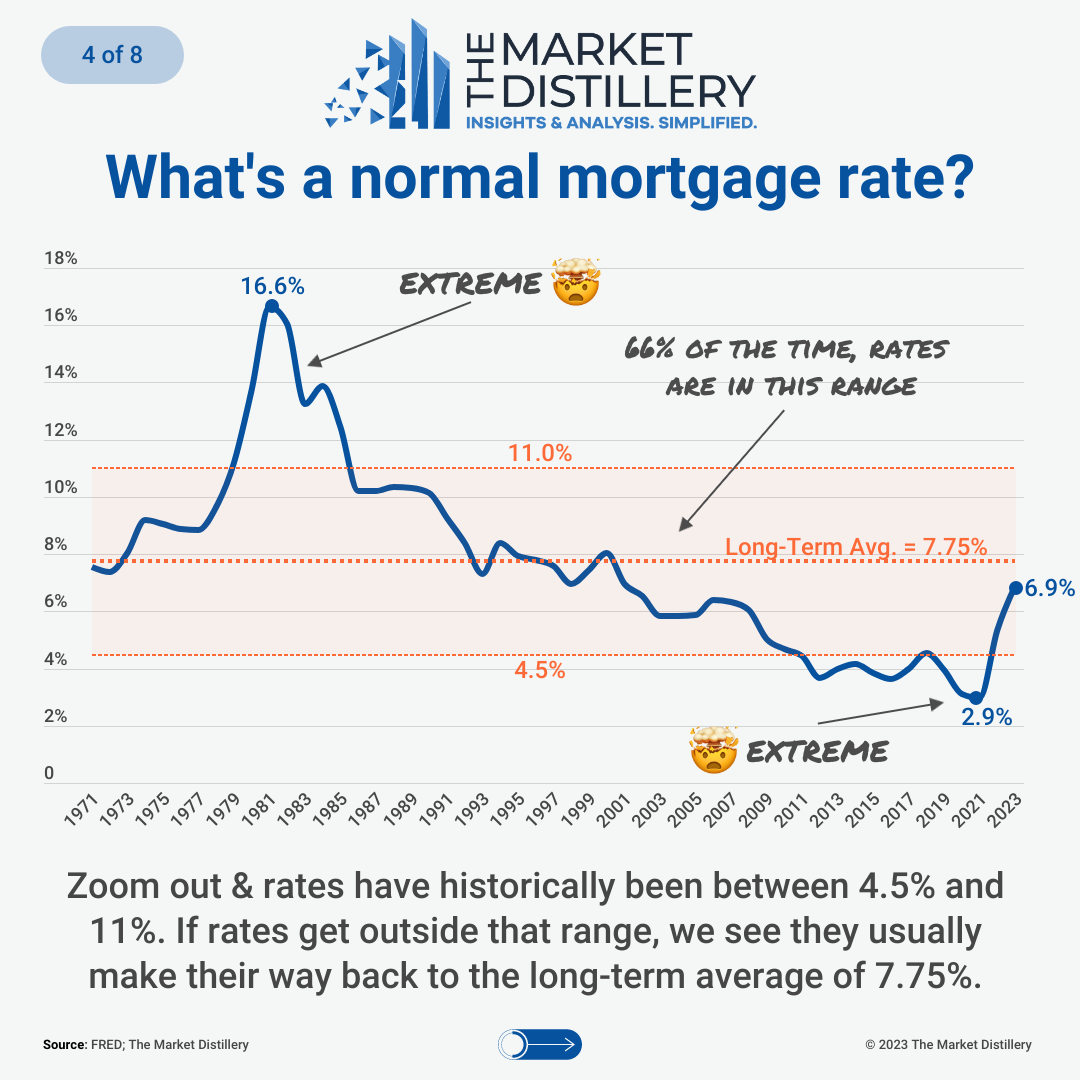

My goal with this graphic was to visualize where rates have been to give us context on where they are now. There are two main callouts on this graphic:

First, the long-term average for 30 year fixed conventional mortgage rates is 7.75%. Below that and you're getting a good deal.

Second, for roughly 2/3rds of the past 50 years, rates are between 4.5% and 11%.

This is so valuable because it shows you where the extreme values are. 😎

If you go outside that orange band, it's not a "normal" rate and you're likely going to whipsaw back towards the average - known as regression to the mean.

Open the Flood Gates at 5%

Next, I wanted to examine the "lock in" effect that is going on.

This is where owners have locked in rates around 3% and won't sell because of the drastically higher costs if they bought at rates today. 🔓🏘️

It's keeping our inventory and the number of transactions very low.

Based off a recent Zillow study, the inflection point for owners to start taking action is around 5%. 🎯

Keep in mind, this doesn't mean a flood of inventory will hit and crash the market. Instead, it would likely be a frenzy as everyone swapped houses while rates were lower.

We'd still be short houses in the end with the non-owner buyers getting in the mix.

What It All Means

Combine these two charts and we have tremendously more context on rates.

Over the past 50 years, rates have lived between 4.5% and 11% for the majority of the time. This is the range odds say we should expect mortgage rates to be going forward. 💡

Also, we've been under the long-term average for the past 20 years so it's reasonable to expect we'd go back around or above that average moving forward.

**Remember: we don't know the future and instead make educated bets based on the data we have.**

Considering most owners are desiring rates at or below 5% to consider selling, this sets us up for a shortage of houses for sale for the foreseeable future.

This means waiting isn't a sure bet to get a good deal on a house. It's more likely to be the opposite and cost you more. 😡

This is why I've been advising my members to get very fluent in new construction as it's most likely going to be the main source of transactions going forward.

School is back in session. Let's get to work! 🚀

Whenever you're ready, there are 3 ways I can help you:

- Market Insiders Coaching Membership: Join an exclusive group of Realtors focused on becoming experts in their local market. This membership gives you access to monthly live coaching from yours truly, a member-only community for private updates and discussions, and additional resources to address clients questions and supercharge your business.

- How to Use Market Stats in Your Business: Accelerate your business growth by learning how to use data. This course will help you more easily understand the market, improve your client presentations, and increase your conversion rate with clients.

Rated 9.84 out of 10 for value to their business by 100+ Realtors.

- Schedule a live presentation: Want to learn in person? I offer quarterly market updates and in-person training in the Jacksonville area. Just submit a speaking request and we can get it set up.

Realtors: want to be confident discussing the market? 🚀

If you're like so many of the Realtors I meet, you know understanding the local market is one of the most important things you can do as a real estate agent.

Everyone asks "how's the market?" when you meet them and the way you respond either opens a door of opportunity or shuts it.

Most Realtors have the stats but don't know what to do with them. There's so much going on that it gets confusing quickly.

If this sounds like you, My Market Insiders coaching could be just what you need. It's part local market updates, part business strategy so that you can be clear about exactly what's happening in the market and how to use that expertise to attract your ideal clients.

Members rate it 9.8 out of 10 for value to their business and increase their confidence talking about the market by 24%.

Click the button below to learn more about the program and if it's right for you ⤵️