Beyond 2008: Jacksonville's Thriving Real Estate Market

Aug 01, 2023

This article is an excerpt from our quarterly economic update available to coaching members. If you'd like to get access to the on-demand recording in addition to other resources, you can join here. If you'd like to have the full presentation in your office, please submit a speaking request.

It's been a wild several years in real estate - especially in Northeast Florida.

2020 and 2021 were out-of-this-world good as rates plummeted to all-time lows and property values skyrocketed. 2022 was the year of two halves. The year started with a bang as rates continued to stay under 5% for the first 6 months of the year, but slowed significantly in the second half as the market adjusted to 7% mortgage rates.

Let's take a look at the first half performance from 2023 for real estate in Jacksonville, Florida.

Defining Jacksonville

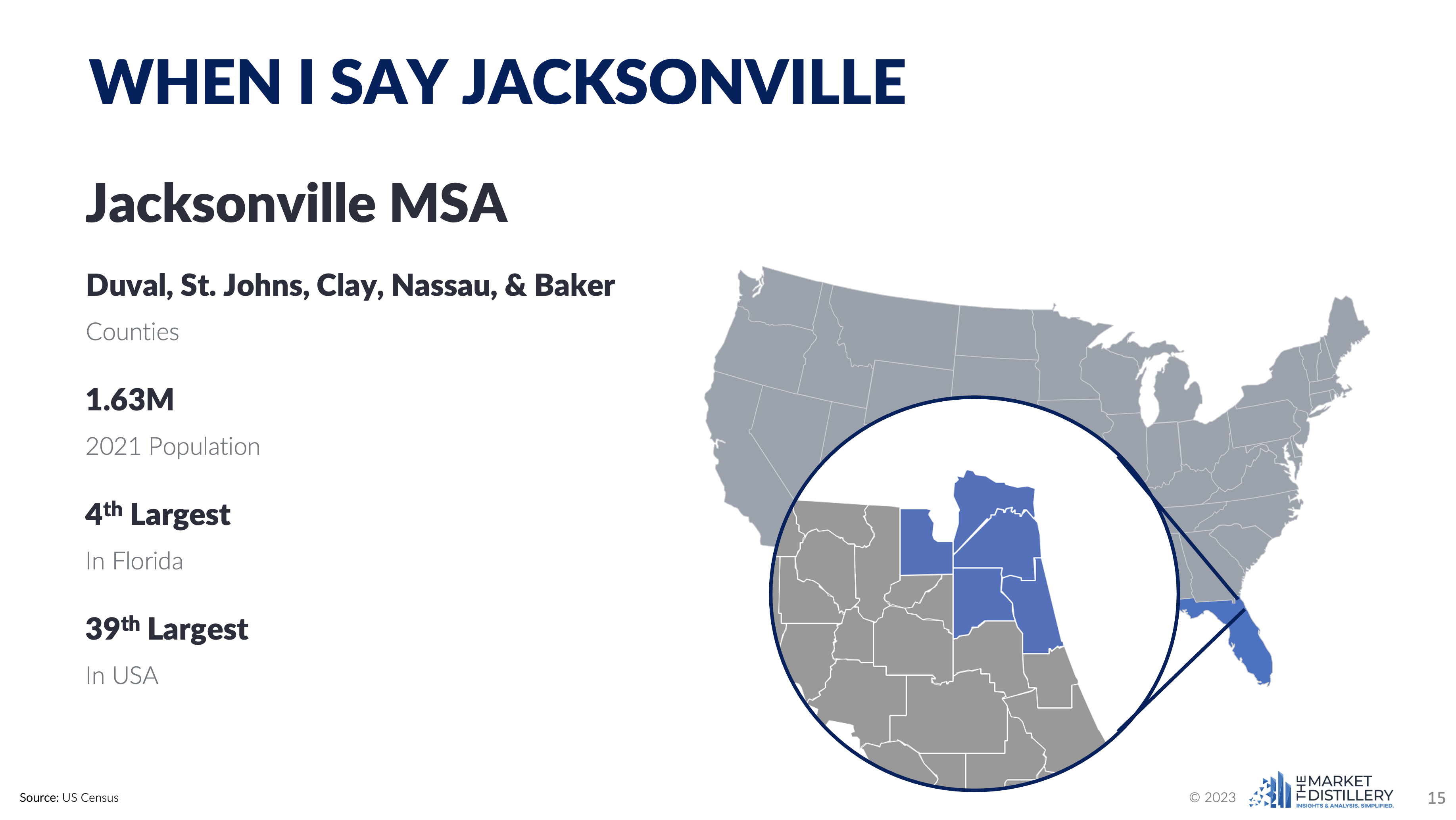

One important point to cover before getting too far is how we define "Jacksonville."

In the analysis and data below, when I refer to Jacksonville, I am referring to the metropolitan statistical area (MSA) of Jacksonville. This includes five counties: Duval, Clay, Baker, Nassau, and St. Johns.

Figure 1. Defining the Jacksonville market

Jacksonville is now considered a major metro within the U.S. and is expected to continue to grow.

Historical Performance

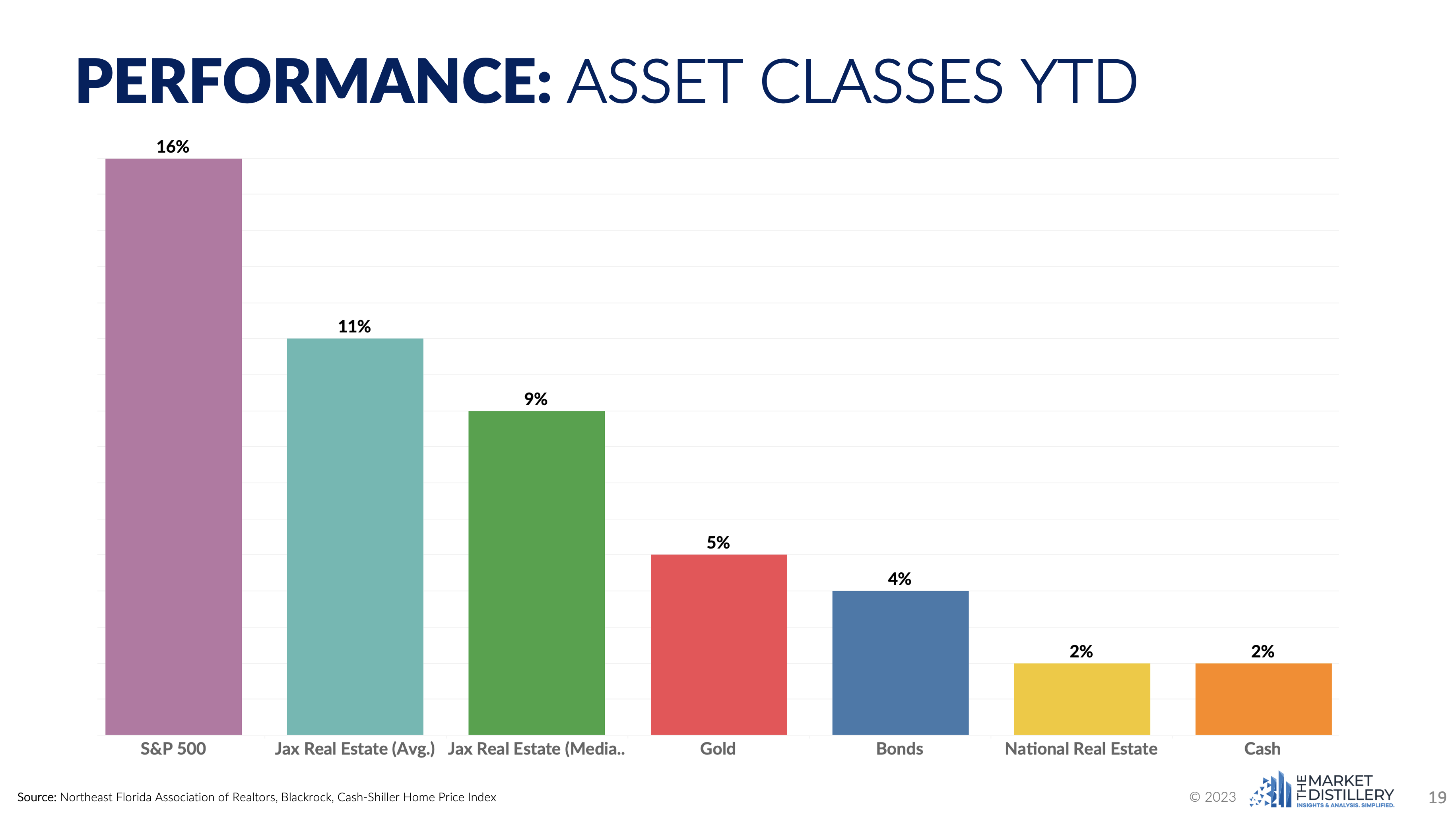

Let's start by reviewing how various asset classes have performed over the first 6 months of the year:

Figure 2. Comparing various asset class performance for the first half of 2023

The stock market has been roaring so far this year after bottoming in October of 2022. Real estate in Jacksonville comes in right behind stocks with the average price up 11% and the median price up 9%.

This is very important and highlights the regional differences that can occur between markets. Consider this, the National indices put first half performance at just +2%. This means Jacksonville outperformed the national average on home value growth by 7-9% depending on your measure of choice.

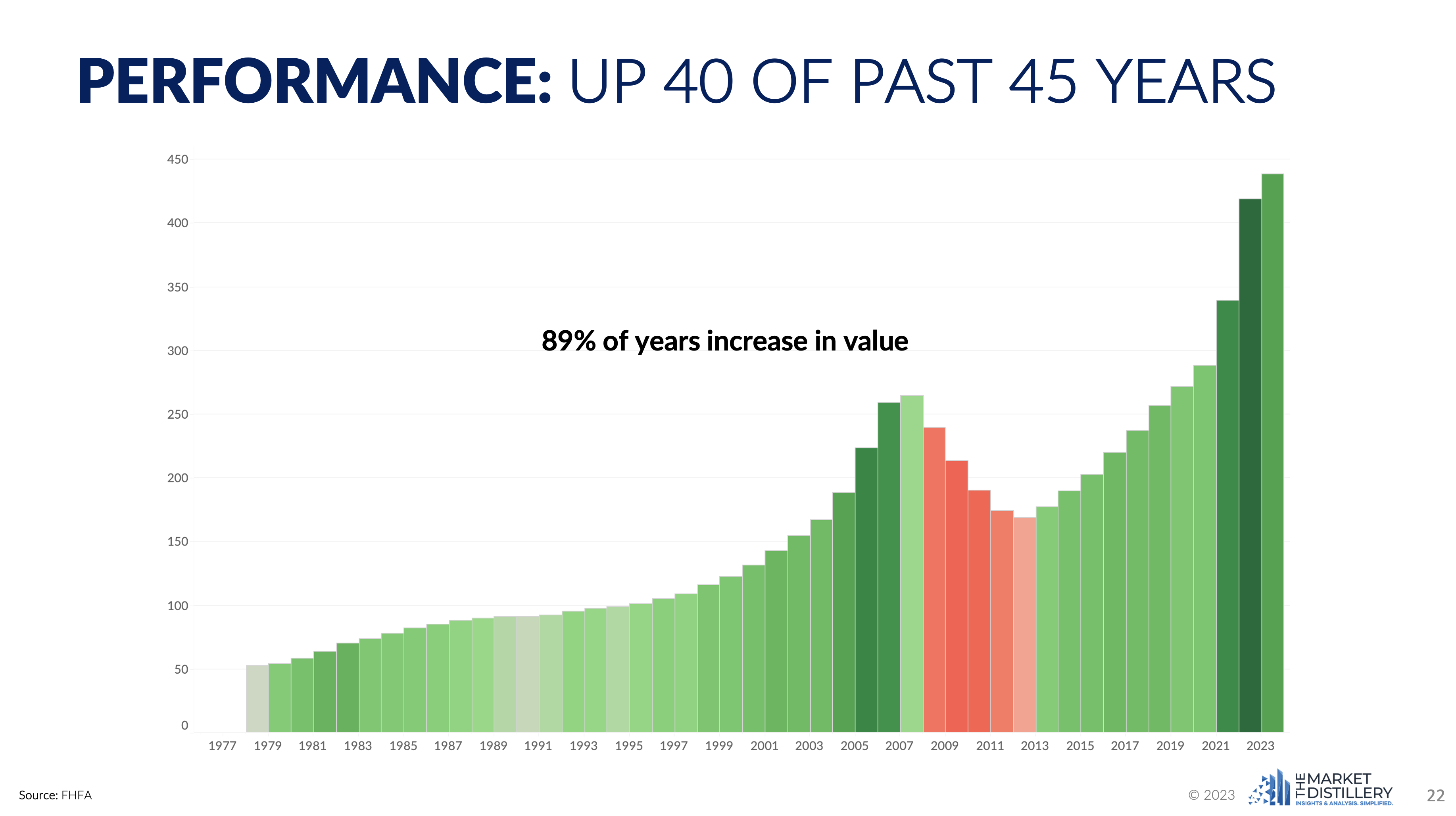

If we zoom out a little further, you can see that Jacksonville's housing market has been a consistent performer. Home prices have risen 40 of the past 45 years based on the Jacksonville Home Price Index. While history doesn't guarantee future results, this is an impressive track record.

Figure 3. Visualizing real estate values over time in Jacksonville

The only time values went backwards was during the Great Financial Crisis of 2008. It's important to note that this crash was caused by real estate. Home values held up well during the other recessions during this timeframe as real estate typically benefits from lower interest rates that have come with recessions.

Main Drivers of Jax's Real Estate Market

Next, we'll shift gears to examine what factors are pushing real estate in Jacksonville to perform at such a high level.

1. Low Supply of Homes for Sale

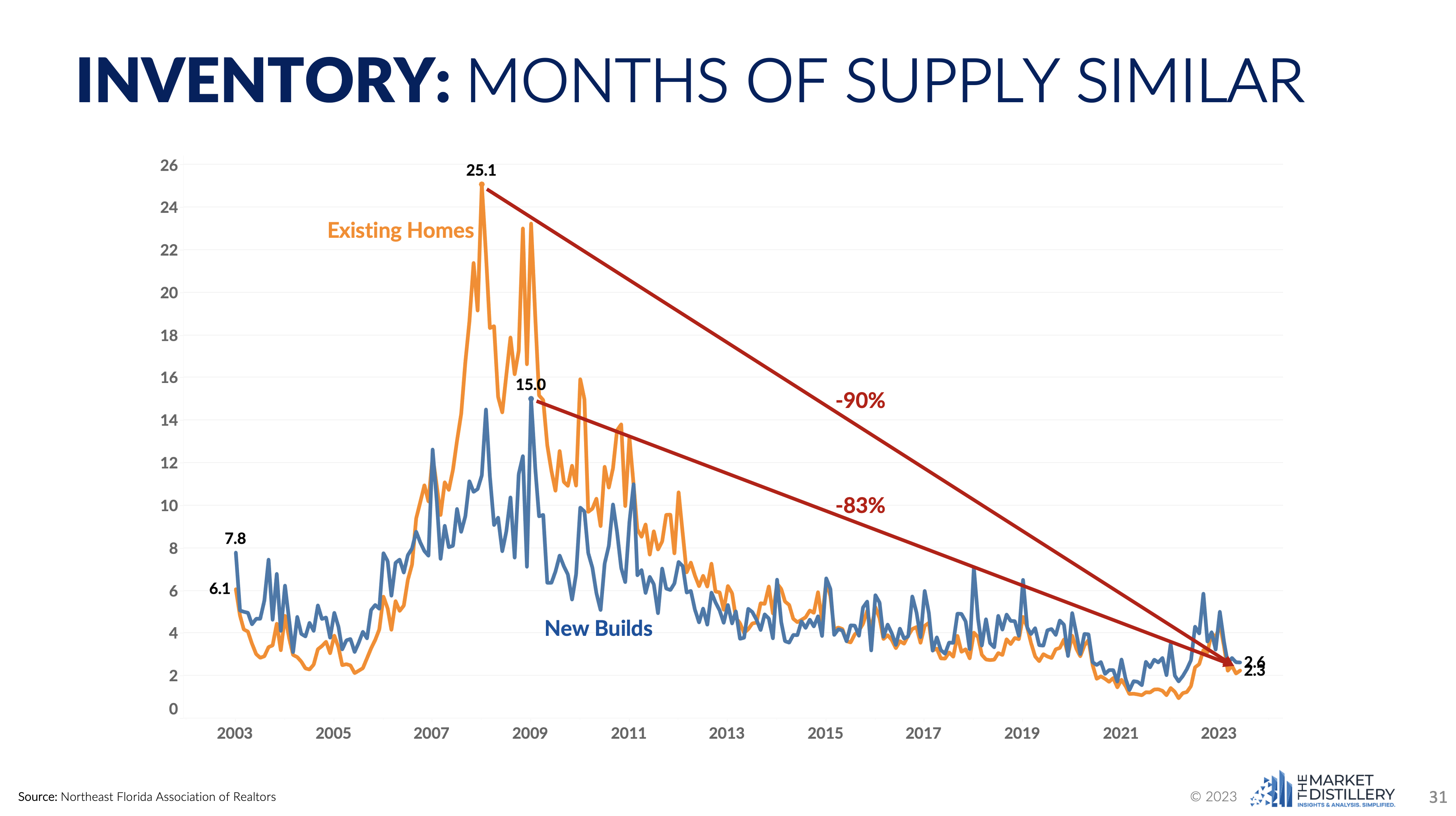

The main driver of higher real estate prices has been the limited supply of homes to purchase. Demand is lower due to higher interest rates, but supply is even lower. This is because of the large number of homeowners who are locked in with 3% mortgages and are choosing to stay put. Further, the new home builders are building at a modest level which is not outpacing demand.

Figure 3. Decline in inventory since 2008 on both new and existing homes in Jacksonville

Above, you can see how inventory has changed over time. We use months of supply to get a consistent measure of inventory because it will scale with population. The statistic represents the number of months it would take to sell out of homes at the current pace of sales.

A value of 6 months of inventory has long been considered a balanced market, but I'd argue nowadays that 4-5 months of supply is more proper. We're currently between 2-3 months of supply for both new and existing homes. This tells us that for the most part, we've got a market where sellers have control.

Important point: without an influx of inventory, we are more likely to see our markets seize up and have a limited number of transactions than we are to see a 2008-type crash.

2. Relocation

Next, a major factor in the growth of Jacksonville and Florida at large is relocation to the area. Locals in each city are concerned with how expensive homes have gotten while outsiders from areas like New York, Chicago, Atlanta, D.C., and Los Angeles are shocked at how far their money goes when they get here.

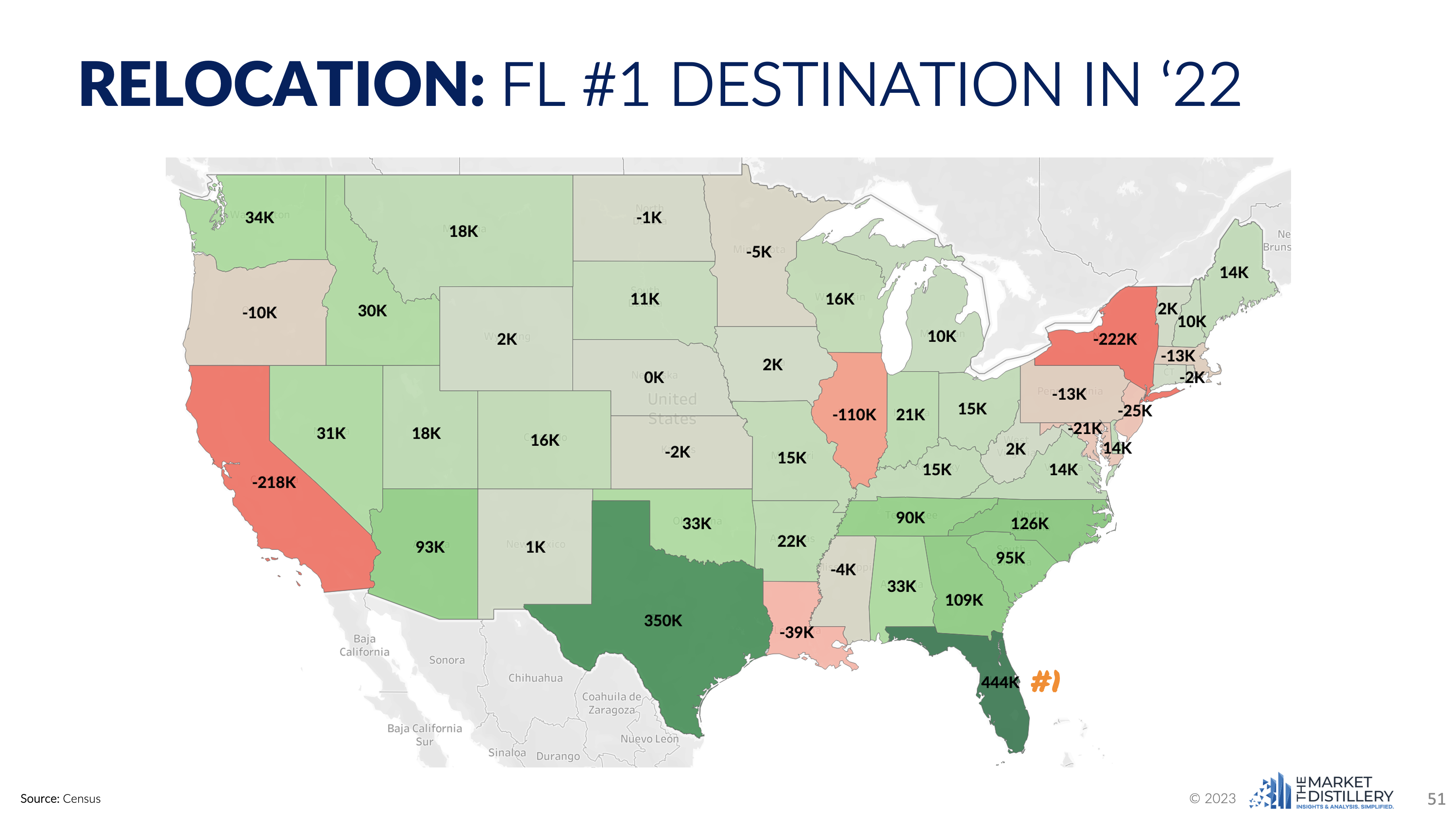

The Census tracks net migration between the states and Florida stood head and shoulders above the other 49 states with a net gain of 444,000 residents in 2022.

Figure 4. Net migration by state (includes deaths, births, and international relocations)

You can see areas like New York, Illinois, and California have some concerns based on the exodus taking place in those states. We are watching to see if real estate values begin to suffer given the lower demand from the relocation away from the areas.

On the other hand, Florida and Texas are the primary beneficiaries of the outflow. This has translated into above average economic and property value growth for the states.

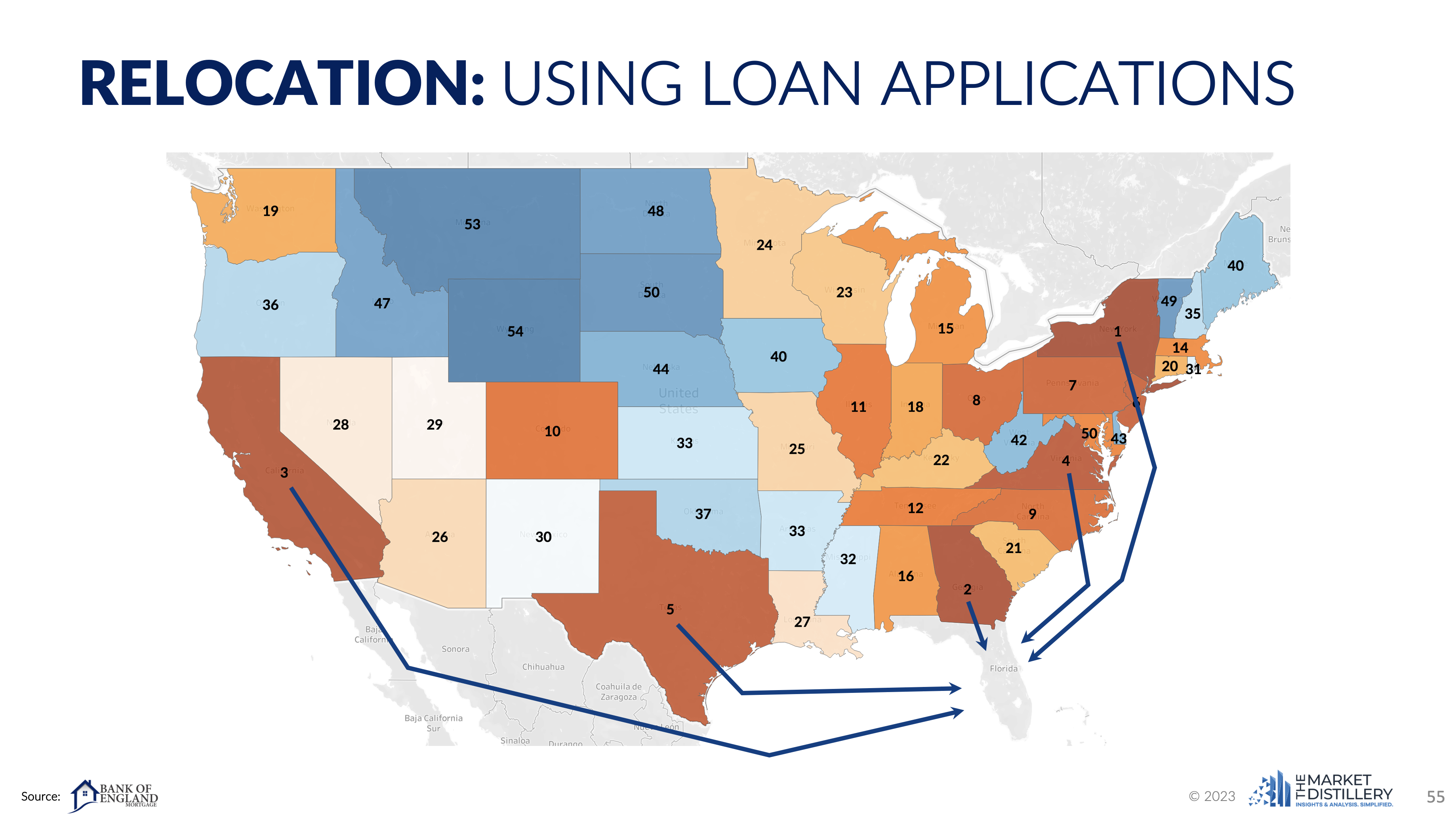

To further identify where people are coming from when relocating to Florida, we use loan application data provided by Bank of England Mortgage. This allows us to rank the states where individuals are leaving to purchase a primary residence in Florida.

Figure 5. States in rank order where new Florida residents are coming from

This relocation trend began in 2018 and started accelerating in 2019. The pandemic didn't cause the relocation, but rather served as a catalyst to supercharge the move to the Sunshine State.

3. Higher Rents

One challenge to the housing market in 2008 was the availability of cheap housing options. This meant that struggling owners could leave their house to foreclosure and find a cheap rental.

Fast forward to 2023 and the rents are anything but cheap. Plus, there are limited options available which further incentivize people considering buying to take the plunge.

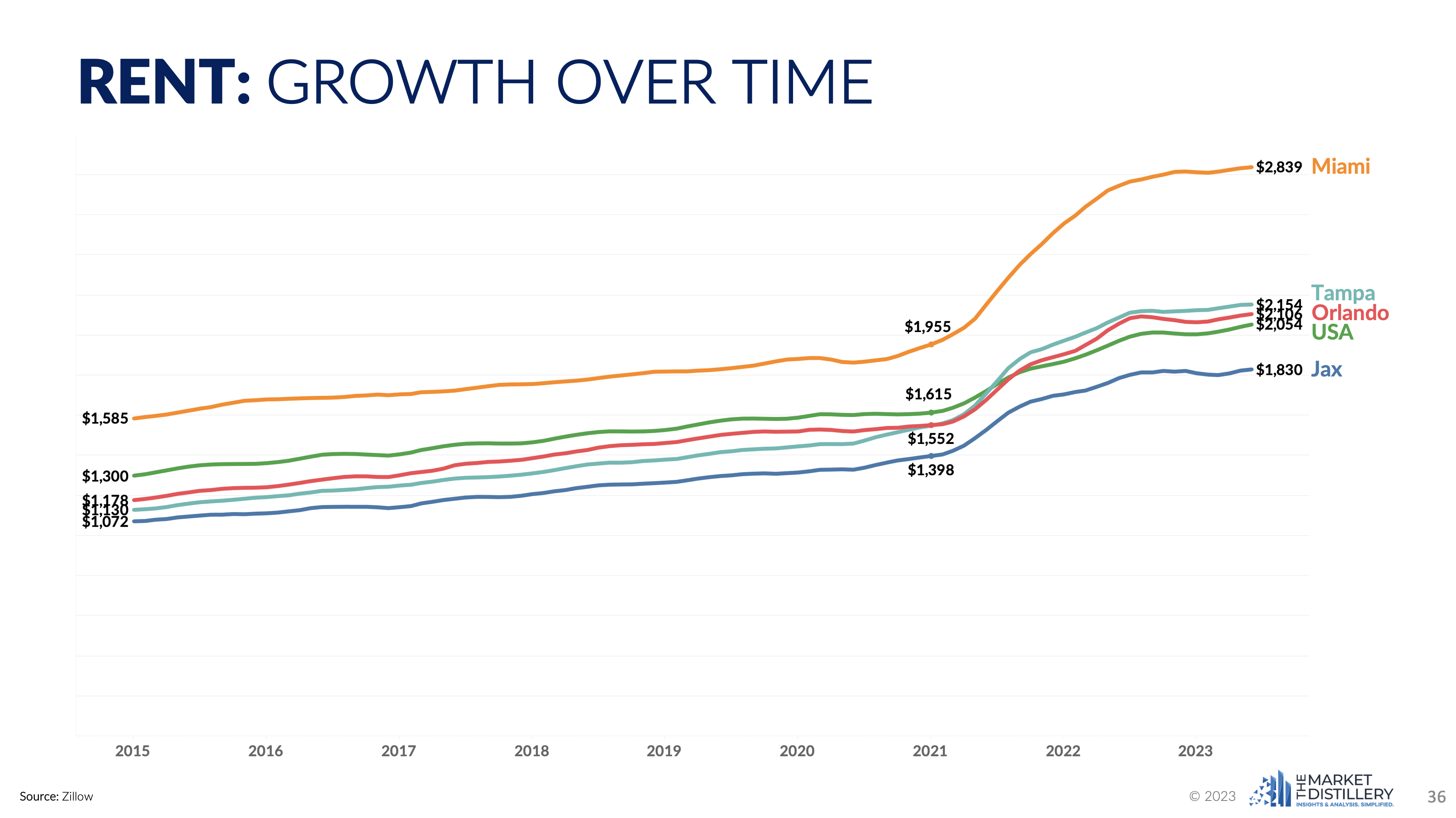

Figure 6. Average rent over time in major Florida metros and U.S.

You can see above that the rent market jumped 30% higher over the past couple years. While we aren't seeing steep increases in rent like in 2021, rent has stabilized and is rising roughly 4% a year. This is the same pace as pre-pandemic trends which suggests it's likely to continue into the foreseeable future.

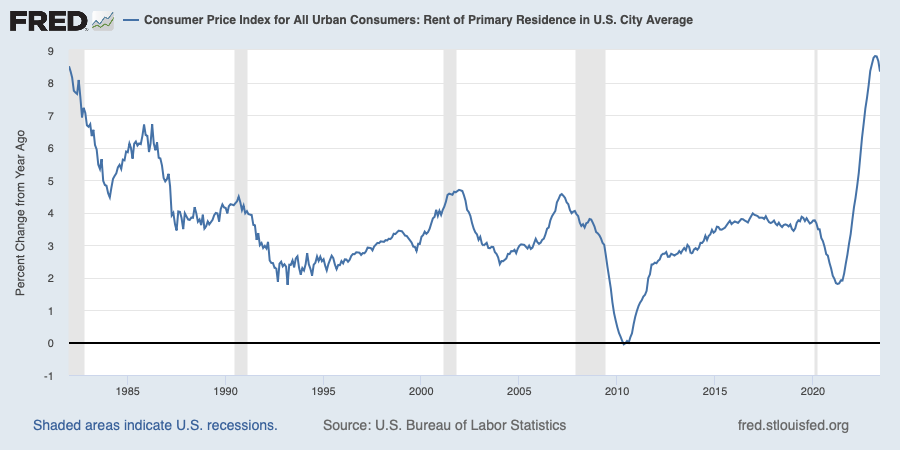

Looking at historical change in rent gives context to the odds of rents declining. There's only been one point since 1982 when rents declined: 2010.

Figure 7. Year-over-year change in rent across the U.S.

Finally, Jacksonville maintains an advantage over Miami, Tampa, and Orlando as rent is roughly $200/month cheaper on average. This is likely to fuel further relocation within the state as locals in the more expensive areas move to more affordable cities.

4. More Confident Consumers

Lastly, making a real estate purchase takes a significant amount of effort and confidence. The process takes roughly 30 days to complete and if anyone has major concerns about their job or the economy, its logical that they'd wait to buy and just rent.

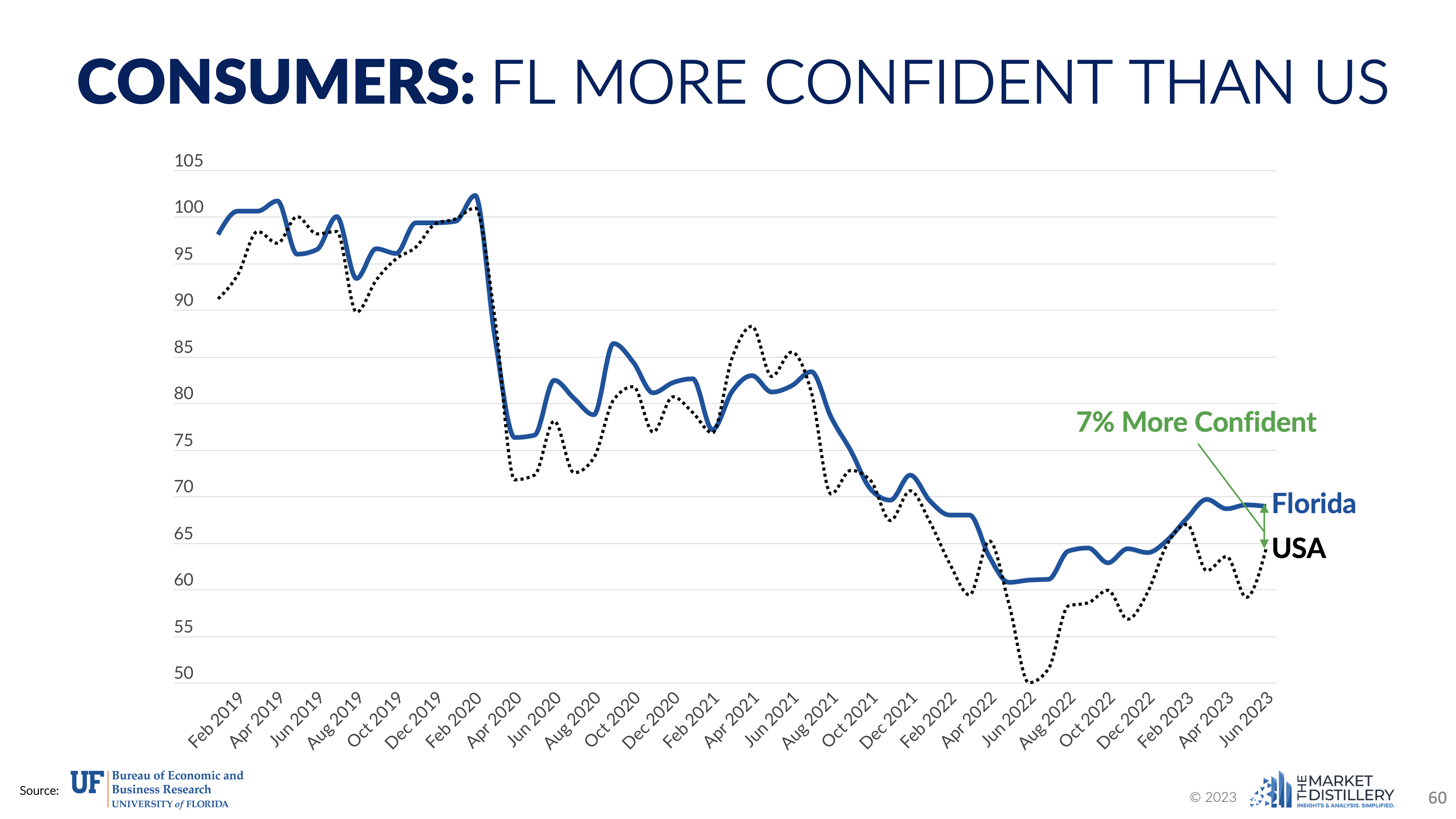

The University of Florida's Bureau of Economic & Business Research publishes a localized Florida Consumer Sentiment Index. This surveys Florida residents using the same questions as the national University of Michigan Consumer Sentiment Index.

Figure 8. Comparing the Florida and National Consumer Confidence Indices

The two indices typically track together, but we've recently seen a gap form with people in Florida leading the national average and feeling more confident. It's worth noting that consumer confidence in general has been shaken since 2019 which can explain why Realtors and consumers have so many questions related to the real estate market and economy.

The recent trend since the middle of 2022 has been a steady increase in consumer confidence. This is positive for real estate and reflects the differences between states when it comes to economic performance. Should we continue to avoid recession and see more economic growth, it's reasonable to expect consumer confidence to grow. This will have a positive impact on the real estate market, especially throughout Florida.

The Bottom Line

Based on this evidence and reasonable projections, it's likely that we will experience continued strength in the Jacksonville (and Florida) real estate market.

While not without challenges (rising insurance costs, hurricane risks, coastal condo assessments, etc.), there are major structural trends in place supporting the economy and population growth. These two sectors combined with an undersupplied housing market suggest home prices will stay elevated and continue growing into the future.

Whenever you're ready, there are 3 ways I can help you:

- Market Insiders Coaching Membership: Join an exclusive group of Realtors focused on becoming experts in their local market. This membership gives you access to monthly live coaching from yours truly, a member-only community for private updates and discussions, and additional resources to address clients questions and supercharge your business.

- How to Use Market Stats in Your Business: Accelerate your business growth by learning how to use data. This course will help you more easily understand the market, improve your client presentations, and increase your conversion rate with clients.

Rated 9.84 out of 10 for value to their business by 100+ Realtors.

- Schedule a live presentation: Want to learn in person? I offer quarterly market updates and in-person training in the Jacksonville area. Just submit a speaking request and we can get it set up.

Realtors: want to be confident discussing the market? 🚀

If you're like so many of the Realtors I meet, you know understanding the local market is one of the most important things you can do as a real estate agent.

Everyone asks "how's the market?" when you meet them and the way you respond either opens a door of opportunity or shuts it.

Most Realtors have the stats but don't know what to do with them. There's so much going on that it gets confusing quickly.

If this sounds like you, My Market Insiders coaching could be just what you need. It's part local market updates, part business strategy so that you can be clear about exactly what's happening in the market and how to use that expertise to attract your ideal clients.

Members rate it 9.8 out of 10 for value to their business and increase their confidence talking about the market by 24%.

Click the button below to learn more about the program and if it's right for you ⤵️