Florida Consumer Sentiment Index | February 2023

Mar 10, 2023

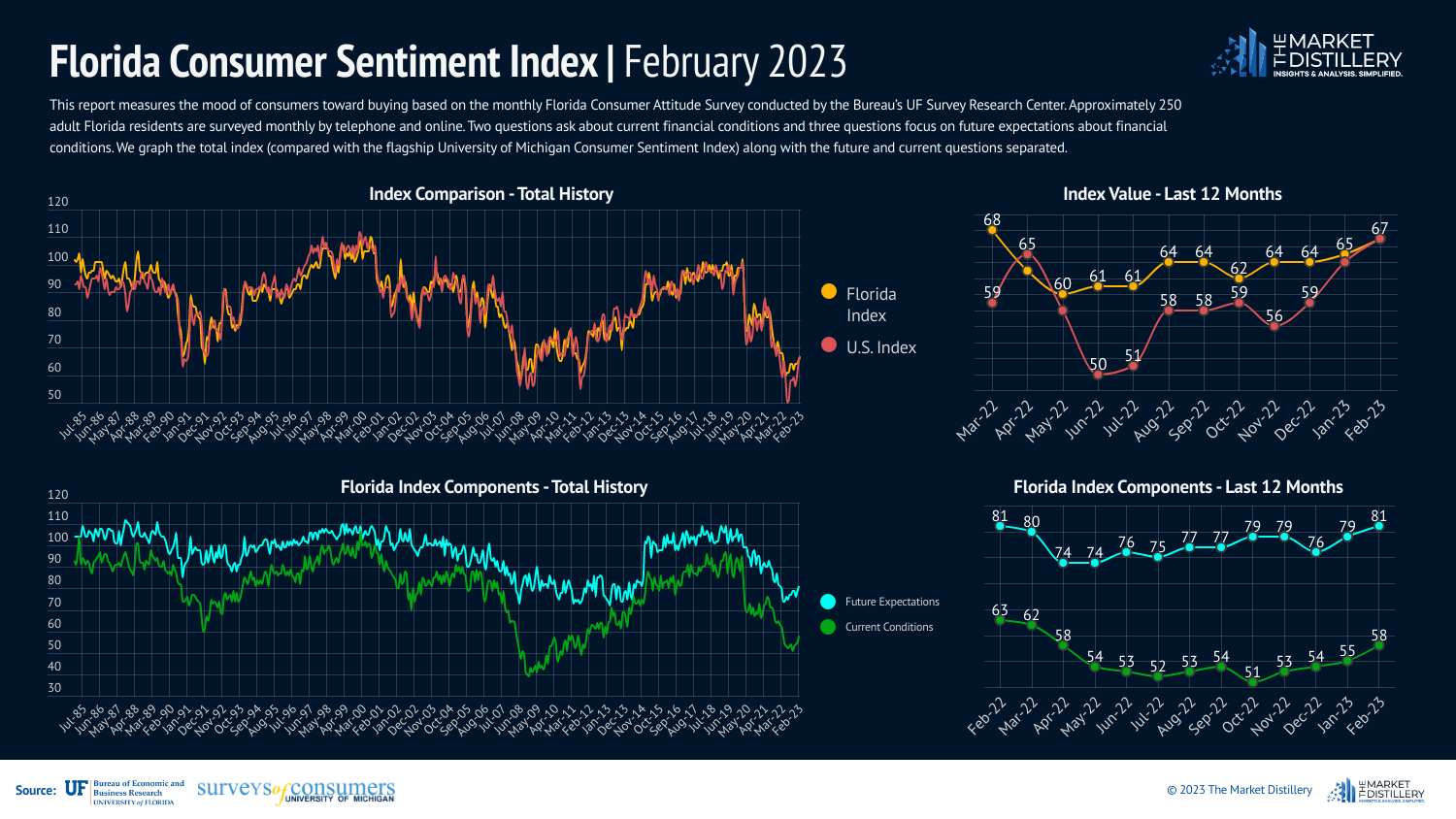

While most everyone has heard of the University of Michigan Consumer Sentiment Index, it is less known that the University of Florida's Bureau of Economic and Business Research (BEBR) produces a more localized version of the index specifically for Florida.

Overall, these surveys are meant to measure how people feel about today's economy as well as how they feel about the future. Respondents are asked 2 questions about current financial conditions and 3 questions about future expectations. The same questions are used in both the Michigan national index and the Florida local index.

This information is valuable as it may predict future consumer behavior and potentially highlight differences in sentiment in Florida compared to the nation as a whole.

Below is our dashboard used to compare the two indices and visualize long-term and short-term changes in the measurements:

Click to View Larger ☝️

Both indices are updated monthly and here are some takeaways from the data that are noteworthy:

- The national and Florida indices are highly correlated and move together. There are certainly some divergences (especially in the past 12 months) which may speak to regional economic outperformance of the Southeast vs. the nation as we've been seeing in various reports, however, we see similar movement between both indices over time.

- The breakout between components (future expectations vs. current conditions) may be useful for identifying major shifts in the markets. We see that people are generally optimistic about what's to come with the future expectations measure almost always coming in higher than the current conditions measure. The major drops in current conditions correspond to recessions and major financial shocks.

- Within the last year, we recorded some of the lowest values for future expectations. This may be relevant to investors as the lows could mark the point where the most people are bearish which is typically when markets bottom out and start to rebound.

- While the measures do move a bit like an EKG measuring a heartbeat in the short-term, there are some major trends visible when you zoom out over time. In the future, we'll be looking at the correlation between the movement of consumer sentiment and other assets to identify opportunities and insights that are valuable to investors.

In total, we believe these indices are of value and want to bring awareness specifically to the Florida Consumer Sentiment Index given our focus on local markets vs. national metrics. We'll be growing our research related to these tools and if you have any questions or suggestions related to this, please leave them in the comments below.

Realtors: want to be confident discussing the market? 🚀

If you're like so many of the Realtors I meet, you know understanding the local market is one of the most important things you can do as a real estate agent.

Everyone asks "how's the market?" when you meet them and the way you respond either opens a door of opportunity or shuts it.

Most Realtors have the stats but don't know what to do with them. There's so much going on that it gets confusing quickly.

If this sounds like you, My Market Insiders coaching could be just what you need. It's part local market updates, part business strategy so that you can be clear about exactly what's happening in the market and how to use that expertise to attract your ideal clients.

Members rate it 9.8 out of 10 for value to their business and increase their confidence talking about the market by 24%.

Click the button below to learn more about the program and if it's right for you ⤵️