Black Friday Real Estate Sale: Mortgage Rates Drop for Thanksgiving

Nov 19, 2023

Wow, what a week!

In case you missed it, I opened enrollment to my coaching and so far there are 24 new Market Insiders ready to learn and grow.

There are still 6 spots left, so don't wait to grab one as I won't open enrollment again until next June and the price will be higher.

Also, how could we talk about anything other than lower rates this week?

Mortgage rates are down ~0.5% and are where they were at the start of October. 🥳

Lets look deeper..

Anticipating Future Changes

It can be difficult to think very far into the future. 🔮

Those who take the time to do it can have a significant advantage in the marketplace.

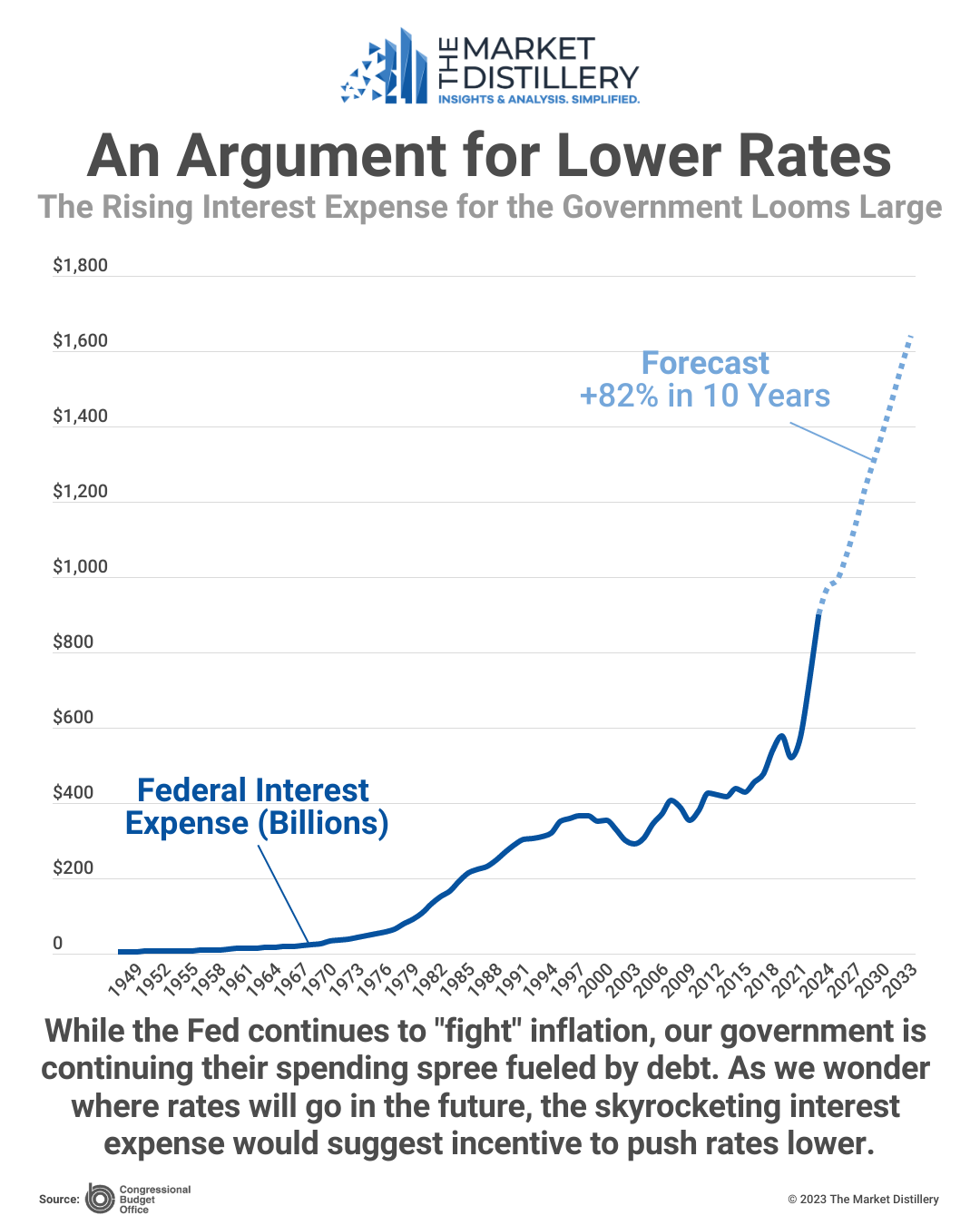

Above is a chart of the interest expense on the national debt.

It's the money the government has to pay on all the money its borrowed over the years. 💰

The dark blue line is the actual expense and the dotted light blue line is the Congressional Budget Office's (CBO) forecast for future expense.

When rates went down to ~0% back in 2020/21, the government chose to use short-term loans (1-5 years) to fund everything.

They did this because the rates were even lower compared to borrowing for 20-30 years so it looked like a good idea at the time.

Think of this like you buying a house with a 5/1 ARM mortgage to get a 2% rate instead of locking in a 30 year mortgage at 3%. 💡

That was fine except rates went up.

Now, they are facing a daunting increase in the interest on their debt as they have to refinance at much higher rates because the loans are coming due.

It doesn't take much to forecast that the government would be highly incentivized to push rates down again ahead of this and then try and lock in long-term debt at lower rates..

The question is can they? 😨

Here's a video with Ray Dalio talking about it further for reference.

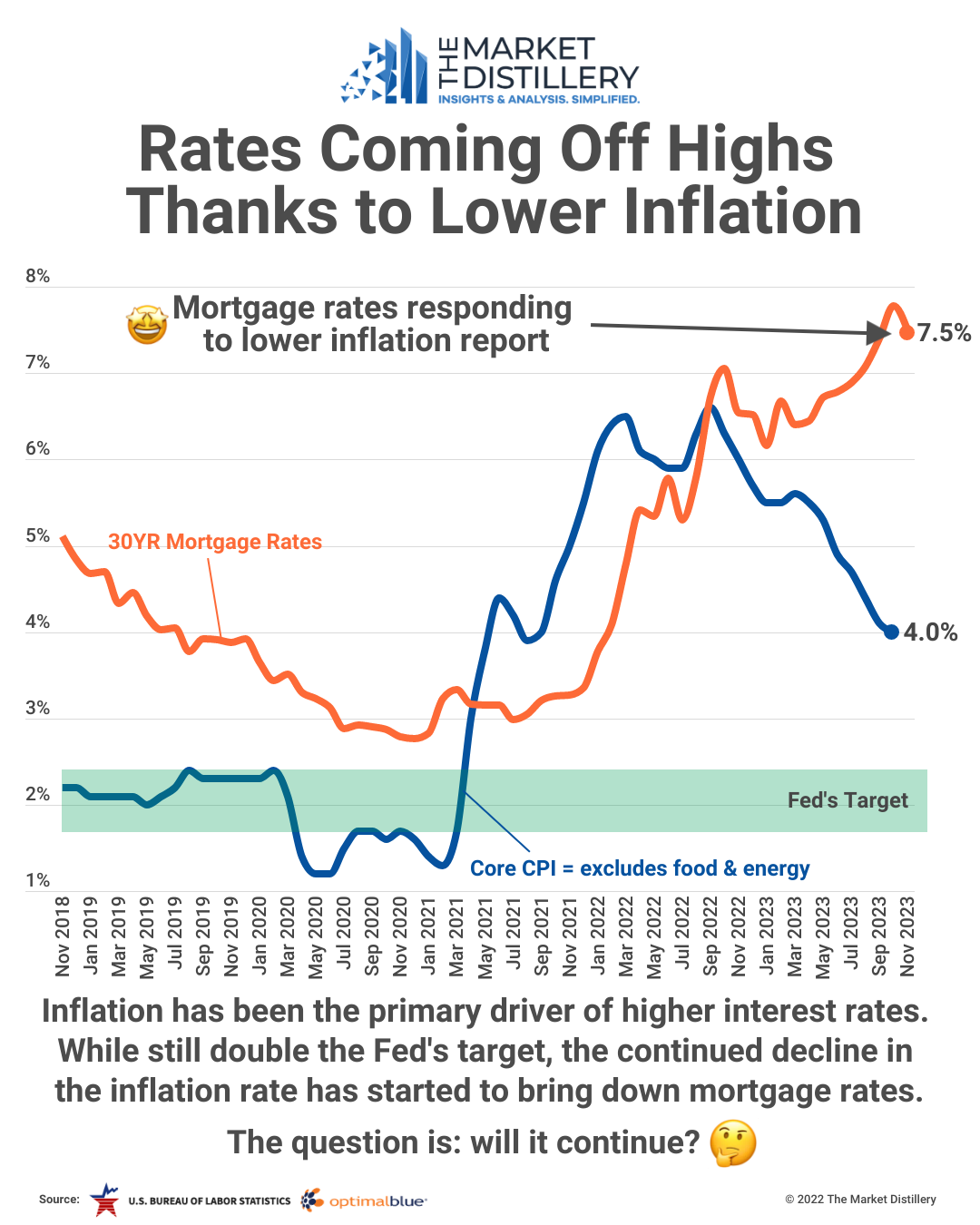

Cooling Inflation Bringing Rate Relief

The good news for everyone is inflation is continuing to decline (based on how they measure it).

And, rates are finally reacting. 👍

Between economic reports showing a slowing economy and lower inflation, we're starting to see rates come down from the peak.

The main assumption is that the Fed no longer needs to press on the brake and may even start to give the market a little gas.

This pushed stocks higher 📈 and rates lower 📉.

Will it last? I'm not so sure. 🤷♂️

But, in the mean time, we should seize the opportunity to take advantage of lower rates while possible.

Finding Opportunity

Predicting the future is near impossible.

That said, you can predict what most people will do if you think about what provides the most short-term benefit to them. 😲

As a real estate professional, we have to be getting in front of our people with these changes in the market.

If you've continually kept your clients updated on rates rising, they are far more likely to take action when an opportunity arises.

It won't take them as long to process what's happening because they've been doing it along the way.

Changes are relative. 6% was the worst thing ever when we were coming up from 5%. It is the best thing ever coming down from 7%.

Be careful: don't judge anything on behalf of your clients. 🤫

Instead, just keep them aware of what's going on, ask them how they feel about it, and if there's anything you can help with.

You might be surprised how much this generates new business for you.

Enjoy the Thanksgiving break and know that I am thankful for you! 🚀

![]()

Dr. Alex Stewart

Founder

P.S. whenever you're ready, there are 3 ways I can help you:

- 🎯 Market Insiders Coaching Membership: Join an exclusive group of Realtors focused on becoming experts in our local Jacksonville market. This membership gives you access to monthly live coaching from yours truly, a member-only community for private updates and discussions, and additional resources to address clients questions and supercharge your business.

Rated 9.65 out of 10 for value to their business by my members. - 👩💻 How to Use Market Stats in Your Business: Accelerate your business growth by learning how to use data. This course will help you more easily understand the market, improve your client presentations, and increase your conversion rate with clients. No finance degree required as I lay everything out in very simple terms.

Rated 9.84 out of 10 for value to their business by 100+ Realtors. - 📊 Schedule a live presentation: Want to learn in person? I offer the MarketPulse 360 presentation that connects all the dots (national to local) so you get a comprehensive breakdown of today's market. It's 2 hours of beautiful charts designed to give you all the major trends you need to know about and address the most common questions in the market. You'll walk out feeling more confident, with resources to use in your business, and a level above the rest of the Realtors who are wandering around blindly.

Rated 9.75 out of 10 for value to their business by 300+ Realtors.

Realtors: want to be confident discussing the market? 🚀

If you're like so many of the Realtors I meet, you know understanding the local market is one of the most important things you can do as a real estate agent.

Everyone asks "how's the market?" when you meet them and the way you respond either opens a door of opportunity or shuts it.

Most Realtors have the stats but don't know what to do with them. There's so much going on that it gets confusing quickly.

If this sounds like you, My Market Insiders coaching could be just what you need. It's part local market updates, part business strategy so that you can be clear about exactly what's happening in the market and how to use that expertise to attract your ideal clients.

Members rate it 9.8 out of 10 for value to their business and increase their confidence talking about the market by 24%.

Click the button below to learn more about the program and if it's right for you ⤵️